Making sense of the GameStop saga

In the second half of the first month of this year, there seemed to be only thing that any one could talk about: the riot at Capitol Hill. In the financial markets however another storm was brewing. Gamestop was all anyone could talk about once Biden was inaugurated and it seemed like the whole world had breathed a sigh of collective relief with Mr. Trump leaving office.

Now if you haven’t been living under a rock, chances are that you have heard of Gamestop and how a bunch of uppity meme-lords over at reddit triumphed over the collective might of Wall Street. A victory for the little guy some proclaimed. Since the dust has settled, let us take a step back and try to understand the whole story. My purpose of writing such a story once the whole drama is past us is to take a deeper look at the various players, mechanisms, and stakes at play and talk about what lessons we could draw from those 2 weeks of crazy activity in the markets. In the process, we will also understand what a short squeeze is, what a gamma squeeze is, whether Robinhood actually threw its customers under the bus, and what is the larger macro picture behind this all.

- Lull before the storm

- GameStop: A Value investment?

- Fundamental Value: A Digression

- The meme narrative

- The Big Short ?

- A lost generation

Lull before the storm

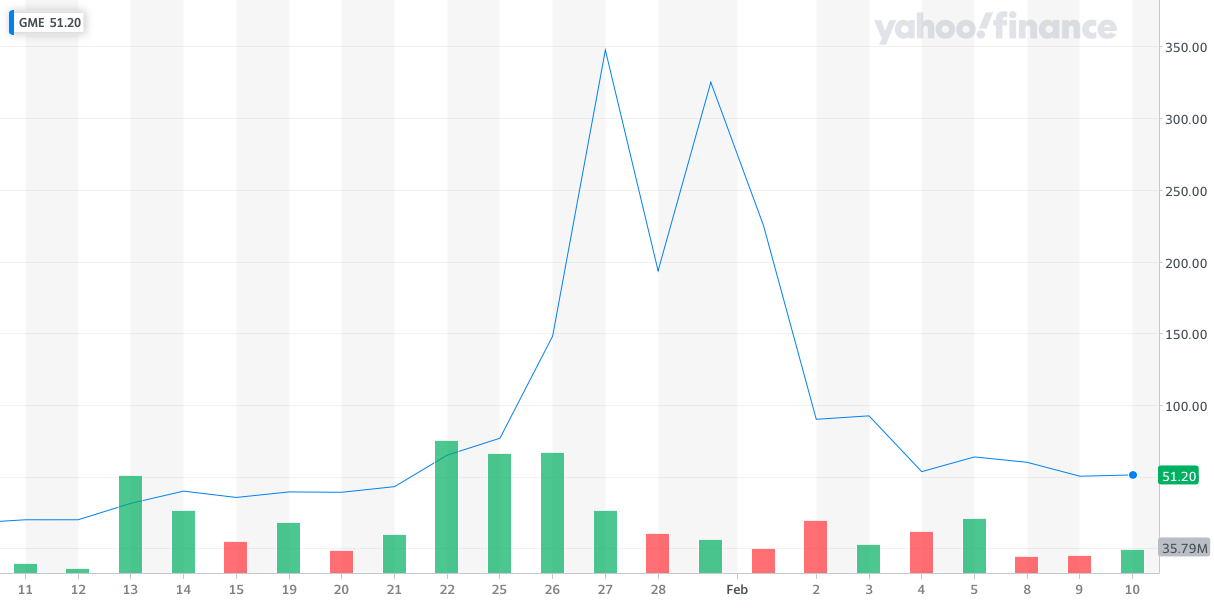

The story of Gamestop can be neatly summed up in one chart below. GameStop is an american retailer which specializes in selling video games and gaming consoles. While the company has been around for some time, public interest beyond the gaming community reached fever pitch mid to late January. The stock price of GameStop which was around 10USD even as late as December 2020 reached stratospheric heights reaching close to 350 USD (at market close) at its peak. During these tumultous 15 days, multiple stories have emerged with various protagonists. Today the price of GameStop is a measly (compared to its short-lived boom period) 51 USD.

So what explains this rapid rise in the stock price of a video game retailer? There are multiple ways in which you can tell this story. The 30 second version is the following: GameStop being a physical retailer was seen as an unviable business. The pandemic and the ensuing lockdowns only hastened what people thought would be the inevidtable decline of the business. Thinking that GameStop would go the way of other firms such as Blockbuster, hedge funds such as Melvin Capital decided to short the stock (more on this later) i.e. made the bet that GameStop’s stock price would go down and they would be able to make a profit. Some folks over on a reddit community (subreddit in the parlance) called Wall Street Bets got wind of this short position and decided to take action. This community was able to generate enough interest and momentum behind the stock that rather than its price decreasing, the stock price increased, against Melvin Capital’s expectations leading to heavy losses for them. This was such a remarkable thing that lots of the business and general press became interested in the story pushing interest in the stock even further. The prevailing narrative that resulted was one of how a bunch of uppity retail (read not big guys such as hedge funds) were able to beat the big guys, a modern day financial David vs Goliath.

GameStop: A Value investment?

It is true that most of the interest during the boom period of GME was driven by the reddit effect, there were other investors who believed that GameStop was indeed being undervalued. They would argue that the fundamentals of the company were actually strong; that the video game industry is different from the video rental industry; that the short-sellers were simply wrong.

This does indeed bear out somewhat. At the start of the pandemic, with businesses closing by the thousands, it would have been natural to assume that GameStop would be severely hit as well. Even before the pandemic, GameStop’s position wasn’t the greatest. However in the summer, they had a big injection of money from an investor called Ryan Cohen. Cohen - who had struck it big with his pet-products company Chewy Inc. - bought a large stake in the company with the aim of transforming the firm into an online retailer. He doubled down on his commitment to the company by sending a harshly worded letter to the board for not fully embracing the idea of making GameStop a strong digital retailer. Given such backing - financial and moral - one would think that the short-sellers would update their position and no longer bet on the demise of the firm. The short-sellers did no such thing and interestingly enough there wasn’t much change in the market price of GameStop either.

Fundamental Value: A Digression

All of this brings up the question of the fundamental value of a stock. The Benjamin Graham-Warren Buffett school of investment is based upon this idea that each stock on the market has something called a fundamental value, something akin to a true value that represents the intrinsic worth of the stock. There is a whole literature devoted on developing and investing on the basis of this notion of fundamental value. However, my position is that the value is more like an emergent quantity - something that is discovered through the interactions and expectations of the actors of the market. In many ways, this point of view would suggest that there is indeed no fundamental value.

The GameStop story would seem to give some backing to this latter point of view. Of course, the fundamental value investors could argue that the fundamental value is linked to many of the core characteristics of a firm - financials, cash flows, etc - are correlated to the fundamental value. Most often this information is publicly available to everyone and in this scenario the market value is the fundamental value.

(Another interesting example is the case of Tesla. While it has long been known that Tesla’s financial situation has not been the greatest, its valuation stands at 700 Billion USD. How is this valuation correlated with its fundamentals? )

I raise the question of value because if we believe that the market value is the only value that makes sense then GameStop has very important lessons for the future. What this story has shown is that the market is not limited to just sophisticated investors with Bloomberg terminals but also to Reddit users and other retail investors who can execute trades from their mobile phones. Its not a story of David vs Goliath but the momentum trade vs the meme trade.

The meme narrative

What is a meme trade? To my mind it is a trade which is driven by a strong narrative which then continues to reinforce itself through imitation (the original meaning of the word meme). The word meme also stands for humorous content that spreads in much the same way. A meme trade is then something which contains aspects of memes: the humorous and the imitational.

GameStop, I would argue, is indeed such a trade. It was the initial narrative of “a hedge fund is shorting a perfectly viable company” (though in much stronger, and shall we say indecorous words) that drove the members of Wall Street Bets to buy GameStop shares, which led to the eventual short squeeze and gamma squeeze. The meme nature of the trade is exemplified by the numerous comments and, well actual memes, such as the diamond hands meme, that drove other people to buy the stock.

Meme trades have been pretty common in the cryptocurrency sphere for some time now. But the introduction of big personalities such as Elon Musk has only ended up accelerating the process: Musk’s tweets supporting Bitcoin or the Dogecoin (the very definition of a meme-coin) are just two examples.

Frodo was the underdoge,

— Elon Musk (@elonmusk) February 11, 2021

All thought he would fail,

Himself most of all. pic.twitter.com/zGxJFDzzrM

In economics, we often talk about narratives : a story or description of economic events that may convince people to behave in a certain way. The idea of narrative economics isn’t new: people telling each other their version of how things will go down in the market and convincing themselves of one position or the other would seem to be a daily occurrence. Thus the meme trade is another instance of the construction of a particular narrative around a particular stock. In the case of GameStop, reddit users convinced themselves that their trading was indeed righteous in the face of the “big bad short seller”, which is in turn the narrative that has eventually stuck in people’s minds.

If the value of a stock can be boosted by such meme narratives, I wonder where it leaves value investing. On the one hand I am sure that the early value investors in GameStop definitely felt that the stock was undervalued, there is, in principle, no strong limits to the upside. What is also true is that later entrants to the trade didn’t particularly care about the fundamentals. They resorted to what I consider was a Schelling solution: they actually had very little information about the inner workings of the trade and ended up cooperating in such a way that the whole reddit community would end up making money.

The Big Short ?

We can also tell the GameStop story from a technical point of view. In this post, I will not go into the math here and focus on the intuition (old physicist’s habit).

Let us start with the term that everyone and their aunt has heard over the last month or so: short squeeze. As I mentioned earlier, shorting a stock simply means that you will bet that the price of the stock will fall and you want to make money off of your bet. The way you do this is as follows:

- you borrow some stock from a broker (posting some collateral).

- you then sell this stock to a willing buyer at the current price of the stock (the spot).

- If as you had expected the stock price falls, you buy back the stock for cheap.

- You return the stock back to the broker. And in the process you have pocketed the spread between what you sold the stock for and the price at which you bought it for.

Excellent! So where is the squeeze? The squeeze occurs when the price of the stock doesn’t go down. Since you are still on the hook for giving back the stock to your broker, you will now have to buy the stock at a higher price than what you sold it for, and hence incur a loss.

This short squeeze, as the story has been told, is essentially how Melvin Capital ended up losing billions of dollars: the hedge fund was down by almost 53% by the end of January. This however is only part of the story.

A lesser-known part of the story concerns something called the gamma squeeze. Closely related to the short squeeze, but not quite. The gamma squeeze was also behind RobinHood shutting down users’ accounts and briging together two of the most polarizing figures in American Politics: AOC and Ted Cruz!

Fully agree. 👇 https://t.co/rW38zfLYGh

— Ted Cruz (@tedcruz) January 28, 2021

The Gamma Squeeze

So what is the gamma squeeze? While a thorough understanding1 would require some technical knowledge about option pricing, we can give a simplified version of events here. When we price an option using the Black-Scholes option pricing model, the model not only provides us with the value of the option but also provides information about other important quantities, commonly known as the Greeks. People trading derivatives have a whole host of Greeks that they track, let us focus on two basic ones: Delta ($\Delta$) and Gamma ($\Gamma$).

The $\Delta$ of an option tells us how the value of the option changes as the price of the underlying changes, in other words it is a first derivative2 and usually quoted between -1 and 1. So if the price of the underlying stock moves by 1 USD and the value of the option moves by 0.2 USD, then $\Delta = 0.2$. $\Delta$ is also an important value because it tells you how much stock you need to buy/sell to hedge your position, if you want to stay neutral.

What does that mean? $\Delta$-hedging is commonly used by the so-called market makers in the financial markets. These are middlemen who stand on both sides of the transaction: if you wish to buy options, they will sell them to you; if you want to sell options, great! they will buy it off you. Market-makers make money by taking advantage of the bid-ask spread: the difference between the actual price and the price they quote you.

Now, market-makers are supposed to have a risk-neutral position. But how is a market-maker taking risk in selling you an option? Lets imagine that you want to buy a call option for GameStop (GME). A call option gives you the right but not the obligation to buy the underlying stock for a fixed price decided beforehand. So if you buy a GME call option dated 19th March 2021 (date of expiry) with the strike price of 60USD, then you have the right to buy before or on 19th March 2021, 100 shares of GME stock for 60USD. Of course, if you are buying a call option, your expectation is that by expiry, the underlying stock’s value is higher than 60 USD, so that you can exercise the option, get the stock for 60 bucks, sell the stock you bought for a higher price, and pocket the difference.

The market-maker in this situation is taking a risk. If the price of GME stock does go above 60USD, then it will have to sell you the stock for 60USD even though the current price of the stock is higher. And in the process, the market-maker will be losing money.

However, market-makers have to stay neutral. The way they do is by… buying the underlying stock. And this is where $\Delta$ comes into the picture: since the market-maker must stay neutral, they must continue to buy stock as the price of the underlying stock moves for each call option they will sell. This process is called Delta-hedging.

It is clear that $\Delta$ itself is not a static quantity but evolves in time. If there is a lot of activity in the stock, which was the case with GME, we have the price of the underlying increases, leading to an increase in the value of $\Delta$ as well. This is what $\Gamma$ is: a change in the value of $\Delta$ as the price of the underlying stock evolves. A second derivative, in other words.

Let us now reconsider what happened with GME: as the short squeeze is occuring, there is a lot of activity in the stock (high volatility) which is driving people on Reddit to buy… more call options (remember they are betting that the price will be higher than the strike price of their options). This call buying is pushing the price of the stock as well as the $\Gamma$ of the options higher. The increased $\Gamma$ puts more upward pressure on the $\Delta$ leading to more stock buying from the market-maker. This ends up pushing the price of the stock even higher… and the cycle continues3.

That is the complete technical story behind the GameStop saga. The $\Gamma$-squeeze is, in many ways related to the supposedly sketchy behavior of RobinHood and the biggest guy in the story yet, Citadel. That is however for another post.

A lost generation

Till now, we have seen the motivations of the major actors for shorting the stock and then the redditors retaliating. There is another aspect of the story which is the role that Robinhood, and by extension Citadel, have played in this story. Why did Robinhood stop trading on its platform? Are they too in cahoots with (even bigger) players such as Citadel? What’s the macro story at play? Is the Fed at fault ? Or is this all a sideshow ? I will discuss all this and more in the next post.

In conclusion, it is hard to look at the story of Gamestop and not wonder what it says about the moment we are living in. The pandemic has dealt a blow to the somewhat sedate recovery that we have had since the 2008 Great Financial Crisis. Looking at some of the comments on reddit as well as the reporting from other sources, it is clear that while there were many who engaged in the short squeeze to stick it to the “big guy”, many did it out of spite for the system. As 2020 has given way to 2021, the reactions of people from my generation, the millenials, is extremely nihilistic. Some of the older millenials have had to face the double whammy of the 2008 recession and the pandemic.

Within all of this, it is not unjustified for them to seek some respite from rising student debt, bleak economic outlooks, and overall a drastically curtailed prospects for the future. Indeed, many young people who profited off the Gamestop saga used their earnings to … pay back their student loans.

Eventually, the Gamestop saga points to a larger demographic problem: the gains from the economic conditions of the last 30 years have been spread unequally, reflected equally in rising inequality everywhere but also in the difference in wealth between millenials and the baby boomers. Continuing to locking out a whole generation from the process of gaining wealth can only mean more meme stocks in our future.

I plan to cover option pricing and the Greeks in more detail in a subsequent post. ↩︎

Looking at the Greeks, I am reminded of the partial derivatives with respect to temperature, pressure, volume etc. that I studied in undergraduate thermodynamics. $\Delta$ is similar to a specific heat and $\Gamma$ is similar to a susceptibility. ↩︎

This is indeed a theoretical explanation for the gamma squeeze. I haven’t been able to get my hands on any data to show exactly the movements of the Greeks. ↩︎